I did not see this as an urban vs rural split. The CBC map shows many urban centres were in favour of scrapping the wasteful Liberal boondoggle created in 1995. I believe Layton made a mistake, by joining the Liberals in abandoning the West for Muclair and Ontario seats. (Time will tell)

|

| Gun Registry Vote CBC Map |

Will the voters out West look to the Conservative Party to defend the lawful interests of aboriginals and Canadian citizens against Big Government?

|

| 15 Largest Urban Centres by Political Party MPs |

The urban areas identified below are defined by Statistics Canada with reference to continuous population density, ignoring municipal boundaries. For example, a rural area within a city's limits may not be included, such as some areas within the city limits of Ottawa, while neighbouring cities that directly continue a city's urban core population will be included, such as Westmount and Montreal.- Wikipedia

|

| Toronto, Montreal, Vancouver voted 45/46 seats to save $ 2 Billion boondoggle |

Why are Liberal, NDP and Bloc MPs obsessed with saving the Long Gun Registry, punishing citizens with fines for a long form Census, wasteful spending on snacks at the G20?

Coalition Talking Points

- Banks are bad they make too much money

- Oil Sands are bad they pollute

- Government is mean and the poor are getting poorer

- Miscellaneous costs including snacks for 20,000 Police at G20 is a national concern

- Fines, delay of employment insurance benefits, denial of passports are necessary for Census compliance

- More money for seniors and the poor

- More money for healthcare, education and social services

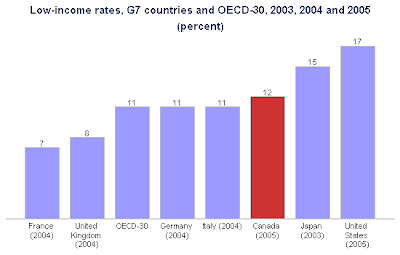

Between 1996 and 2007, the low-income rate among Canadians declined from 15.2% to 9.2%-a substantial decrease of 41%. This also represents an improvement in recent years. In 2005, for example, 10.8% of Canadians experienced low income; in 2003, the rate was 11.6%. - Canada's Performance Report 2008-09: The Government of Canada's Contribution

I noted 15 largest urban areas is 11.1% vs national average of 9.2%.

Media and opposition are distracted on a private members bill?

Long Gun Registry Vote After-Math

- MPs representing "urban" ridings voted 109:58 in support of the registry. Of those opposing the registry from urban ridings, all but one were from the Conservative caucus, along with Jim Maloway from the NDP.

- MPs representing "rural" ridings voted 93:44 against the registry. The rural Yeas were overwhelmingly eastern and central, with just 3 rural MPs in western and northern Canada voting to support the registry (1 Liberal and 2 New Democrats). In Ontario, more rural NDPers voted in favour of the registry than opposed (5:2). Both Independent MPs represent ridings classified here as "rural".

Prime Minister Stephen Harper said he would not let the result deter him. "The people of the regions of this country are never going to accept being treated like criminals and we will continue our efforts until this registry is finally abolished."

|

| Canadian Media |

Canada's Economic Action Plan: A Sixth Report to Canadians - September 2010

The media is fixated on repeating the talking points of the opposition parties without holding them to account to provide a credible alternative.

Tax Relief for Individuals and Families

The Economic Action Plan introduced significant new personal income tax reductions that have provided relief, particularly for low- and middle-income Canadians, as well as measures to help Canadians purchase and improve their homes. For example:

- The amount of income that Canadians can earn before paying federal income tax was further increased, and the top of the two lowest income tax brackets was increased so that Canadians can earn more income before being subject to higher tax rates.

- The Working Income Tax Benefit, introduced in Budget 2007, has been effectively doubled. This enhancement lowers the "welfare wall" by further strengthening work incentives for low-income Canadians already in the workforce and encouraging other low-income Canadians to enter the workforce. Canadians have been able to receive enhanced benefits since filing their 2009 income tax returns.

- The level at which the National Child Benefit supplement for low-income families is fully phased out and the level at which the Canada Child Tax Benefit begins to be phased out have been raised, providing a benefit of up to $438 in 2010 for a family with two children. Additional monthly benefits under these programs began to be paid to families with children in July 2009.

- The Age Credit amount was increased by $1,000 in 2009 to provide tax relief to low- and middle-income seniors. With indexation, this means additional tax savings of up to $151 for low-income seniors in 2010.

- To assist first-time home buyers, Canada's Economic Action Plan provided a tax credit of up to $750 as well as additional access to their Registered Retirement Savings Plan savings to purchase or build a home.

- An estimated 4.6 million Canadian families benefited from up to $1,350 in tax relief from the temporary Home Renovation Tax Credit on eligible renovation projects. Canadians were able to claim the credit when they filed their 2009 income tax returns.

Why is the media and the opposition avoiding an in-depth analysis and rebuttal of the information in the Sixth Report? Why are they both ignoring the economy and asking rhetorical questions?